Utah Real Estate Market Update: Prices, Rates & Predictions

The Utah real estate market continues to evolve as we near the end of 2025, offering both opportunities and challenges for buyers, sellers and investors alike. In this post, we’ll provide a comprehensive update on home prices, interest rates, and key predictions for what’s ahead, and highlight how partnering with a trusted local team like Mountain Valley Utah Realtors can help you navigate the terrain.

Current State of the Market: Home Prices

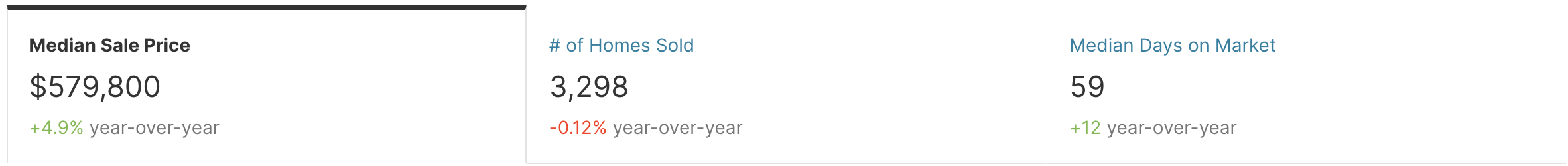

In Utah, home prices are showing modest growth rather than the rapid escalation seen in prior years. According to Redfin, the median sale price in Utah during October 2025 was about $579,800, representing a 4.9 % year-over-year increase. Redfin Meanwhile, data from Zillow puts the typical home value at roughly $530,173, up 2.2 % over the past year. Zillow

What this tells us: while prices are still increasing, the pace has slowed. The market is shifting from a sky-high growth era to a more sustainable, measured climb.

Also of note: inventory is increasing. For example, Redfin reports that homes for sale in Utah in October were up 14.8 % year-over-year. Redfin More choices for buyers may help moderate upward pressure on prices. A separate analysis projected statewide median home price for 2025 hovering around $558,000, representing ~2-3 % growth. Harvestparkgroup.com

Interest Rates & Buyer Conditions

While precise current mortgage rates vary, the broader U.S. interest-rate environment remains elevated compared to the ultra-low rates of the recent past. Higher rates increase monthly payments, which affects buyers’ purchasing power and thus the dynamics of the Utah real estate market.

Given the increased supply and moderated price growth, buyers are gaining a bit more negotiating leverage compared to the frenzy years. Sellers, meanwhile, need to be realistic about pricing and preparation.

For both buyers and sellers, working with a knowledgeable local brokerage like Mountain Valley Utah Realtors gives you an edge: we can help interpret how rates are impacting affordability in your specific market segment (city, neighborhood, home-type) and advise on timing, strategy and negotiation.

Predictions: What’s Next in Utah’s Market

Looking ahead into the remainder of 2025 and beyond, here are some key predictions for the Utah real estate market:

Modest price appreciation. Several expert forecasts suggest growth in the 1 – 3 % range, rather than the double-digit jumps of previous years. For example, one investment-guide projected annual growth at just 1 – 2 % in 2025.

Supply catching up. With more listings coming online and inventory rising, sellers may face more competition, and buyers may have greater choice and less pressure. Harvestparkgroup.com

Shift in market power. In many areas of Utah, the pendulum is shifting slightly toward buyers; meaning longer days on market, more concessions from sellers, or slower escalation of offers.

Interest-rate sensitivity. If mortgage rates decline, we could see a boost in activity; if rates climb further, buyer affordability will become more constrained. Strategic timing becomes more important.

Neighborhood and product-specific variability. The “Utah real estate market” is not a single monolith: different counties, cities, and home-types (e.g., condos vs. single-family) may diverge substantially. For example, some rapidly growing suburbs are seeing stronger demand than slower growth rural areas. Redfin

What This Means for Buyers and Sellers

For Buyers

Use the current slower price-growth window to your advantage: more inventory, less bidding-war pressure.

Still get pre-approved for a mortgage and understand how interest rates will influence your monthly payment and budget.

Work with a local expert, like Misty Biggs & Charlene Walker of Mountain Valley Utah Realtors who knows neighborhood-specific trends and can help identify opportunities before they become widely known.

Consider a longer-term hold strategy (5-10 years or more), since rapid flips are less likely to generate outsized returns in a moderate-growth environment.

For Sellers

Realistic pricing is critical: given increased inventory and slower growth, over-pricing risks your home spending significantly more time on market.

Prepare your home for sale: condition and presentation matter more than ever when buyers have more options.

Partner with Mountain Valley Utah Realtors to evaluate current comparable sales, interpret local buyer demand, and time your listing to maximize impact even in a tempered market.

Be open to negotiation: more buyers are in the driver’s seat now, so flexibility can help you close at a favorable net result.

Why Work with Mountain Valley Utah Realtors?

When navigating the Utah real estate market in 2025, local expertise is more critical than ever. Mountain Valley Utah Realtors is equipped to offer:

Deep knowledge of Utah’s micro-markets: We track trends not just at the state level but down to neighborhoods and price tiers.

Guidance tailored to current conditions: With price appreciation slowing and inventory rising, the tactics differ from the boom years.

Support adapting to rate-sensitive buyers and more competitive seller environments.

Proven track-record of helping clients buy and sell in changing markets, with strategic insight, pricing optimization, and professional negotiations. Check out some of our 5-Star reviews here.

Whether you’re a first-time buyer, moving up, downsizing, or investing; partnering with Mountain Valley Utah Realtors gives you access to data-driven guidance, local insight and a team committed to your outcomes.

In Summary

The Utah real estate market is entering a more balanced phase in 2025: steady price growth, rising supply, and a rate-sensitive buyer pool. For those looking to buy, sell or invest in Utah, this moment offers opportunity, but also requires thoughtful strategy. By staying informed, realistic and partnering with a trusted local brokerage like Mountain Valley Utah Realtors, you’ll be well positioned to navigate today’s market and capitalize on whatever the next chapter brings.

If you’d like to dive deeper into neighborhood-specific trends, interest-rate scenarios or how to craft a buying or selling strategy in Utah’s 2025 market, we would be happy to help!